Heres how you say it. Tax Exemption on Benefits in Kind Received by an Employee 14 9.

Best No Annual Fee Credit Cards February 2022 Creditcards Com Credit Card Best Credit Cards Cards

These benefits are explained in detail in Public Ruling No 52019.

. In Malaysia not more than three times a year. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money. BENEFITS-IN-KIND FOURTH ADDENDUM TO PUBLIC RULING NO.

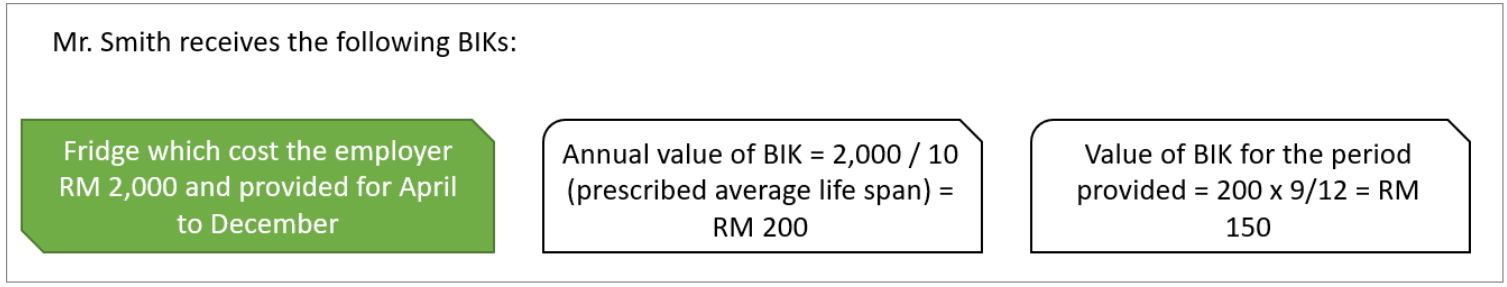

Jamess Use of Car RM 9 600 x 912 months RM 7 200. 112019 provides for the following exemptions. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

3 local leave passages including fares meals and accommodation. BIK are non-monetary benefits. 12 December 2019 Page 3 of 27 under paragraph 131a of the ITA.

Deduction Claim 24 13. Benefits In Kind Employment Income. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the Leong is regarded to be used privately if.

Monthyear of deduction agreed by the employer. Need to translate benefits in kind to Malay. Tax Exemption On Perquisites Received By An Employee 18 8.

Kind Malaysia Virtual 2021 I 7-9 September 2021 Connecting Corporates with Civil Society - Time To Be Kind. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable.

Perquisites are taxable under section 4 b of the ITA as part of the gross income from. 19 April 2010 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. This means that these benefits cannot be converted to cash when they are given to the employee.

In Malaysia company car benefit falls under Benefit in Kind or BIK in short form. 5 minutes Editors Note. Child-care centres provided by employers.

Kind malaysia ubm malaysia connection corporates partnership humanitarian share inspire encourage recognise expertise non-profit kindness csr corporate social. These non-monetary benefits are considered as income to the employees. INLAND REVENUE BOARD MALAYSIA BENEFITS-IN-KIND Fourth Addendum to Public Ruling No.

These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. Employers Responsibilities 30 9. Free transportation between pick-up pointshome and work.

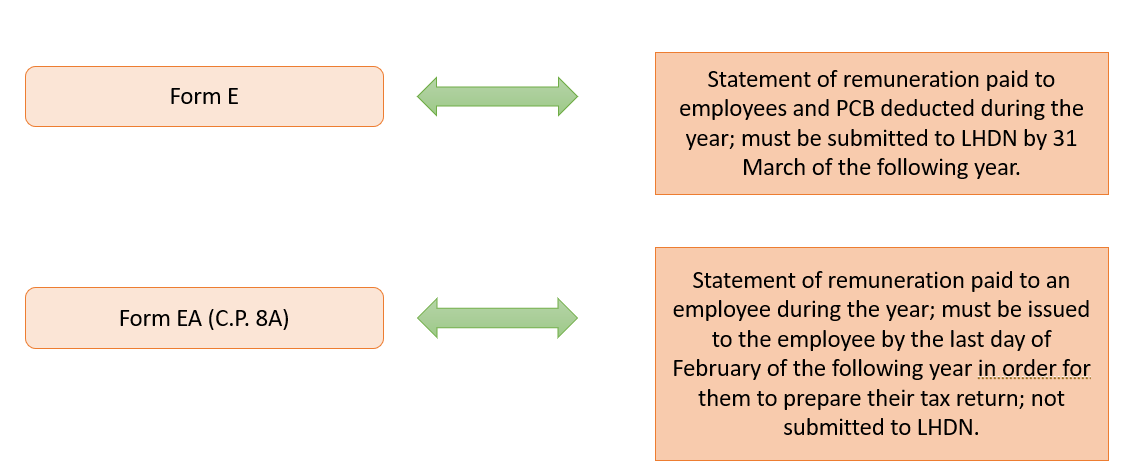

What is Form EA. Ascertainment of the Value of BIK 51 Subsection 321 of the ITA provides. Remaining working month in a year including current month.

Inland Revenue Board of Malaysia. One overseas leave passage up to a maximum of RM3000 for fares only. Benefits in Kind 2 5.

The Distinction Between Perquisites And Benefits In Kind 2 5. All Benefits-in-Kind are technically taxable but Paragraph 8 of the LHDNs Public Ruling No. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging.

Employers Responsibilities 22 10. 12 December 2019 Page 2 of 27 b Where the relationship does not subsist the person who pays or is responsible for paying any remuneration to the employee who has the employment notwithstanding that the person and the employee may be the same person. Other Benefits 14 8.

Formula BIKVOLA calculation. Ascertainment of the Value of Benefits in Kind 3 6. This article was published in Feb 2020 and updated in Jan 2022.

Lets have a look at how you can declare it by giving you a real-life scenario. What is Benefit In Kind BIK. Under the MTD system it is mandatory for an employer to deduct tax from an employees total gross monthly remuneration which includes perquisites Benefit-in-Kind and VOLA etc whether it is paid in or outside of Malaysia and remit it to the MIRB by the 15th of the following month.

112019 Date of Publication. Value of car in a year. Overseas not more than once a year with tax.

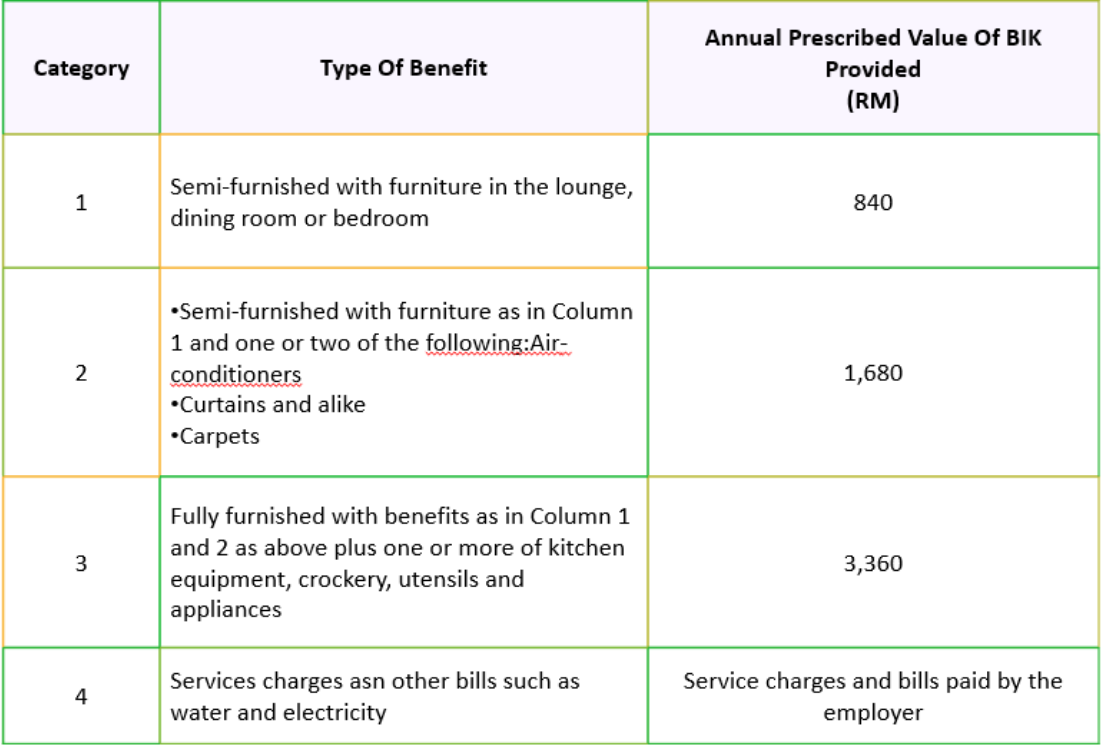

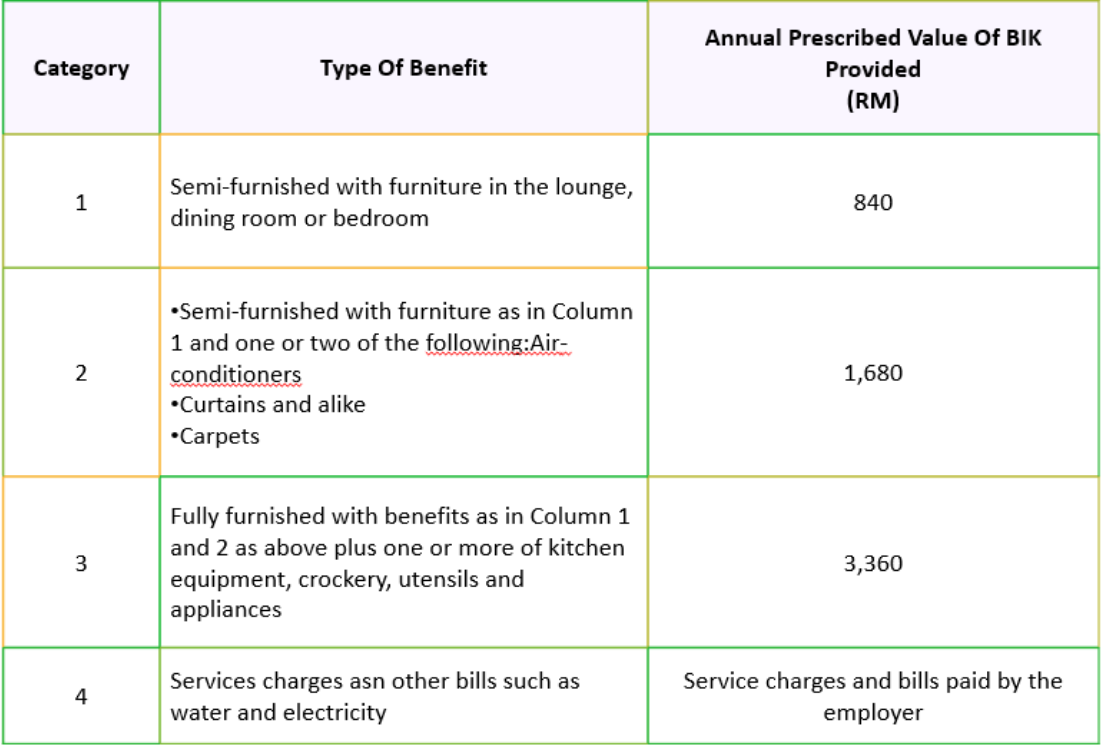

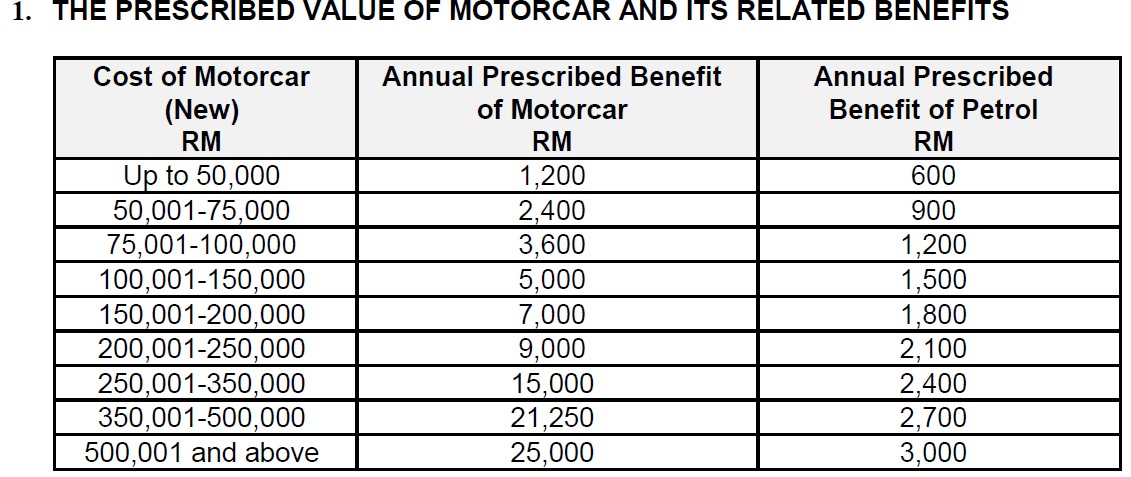

ANNUAL PRESCRIBED VALUE OF BIK PROVIDED RM. 22004 Date of Issue. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

112019 Date of Publication. Types Of Perquisites And The Tax Treatment 7 7. Relevant Provisions of the Law 1 3.

Particulars of Benefits in Kind 4 7. ATXB 213 MALAYSIAN TAXATION I 8 Sec 13 1 a - Perquisite Perquisites are benefits in cash or in kind which can be converted into money received by an employee from his employer or from third parties in respect of having or exercising an employment. The value of BIKVOLA for a year is the actual benefit received by the employee.

Semi-furnished with furniture as in Column 1 and one or two of the following. Food drink provided free of charge. Perquisites from Employment dated 19 November 2019.

Motor cars provided by employers are taxable benefit in kind. Jamess Petrol 1 Apr 2018 31 Dec 2018 RM 6 000. Semi-furnished with furniture in the lounge dining room or bedroom.

Discover the critical impacts of being kind to our community. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. Employees Responsibilities 23 11 Monthly Tax Deduction 23 12.

List Of Tax Deduction For Businesses Cheng Co Group

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Which Benefits Are Tax Exempt For Employees In Malaysia Ya 2021 Althr Blog

Compare And Apply For A Debit Card In Malaysia Debit Instant Payday Loans Same Day Loans

What Is Formula 1 Reviewing Herbalife S Bestselling Protein Shake

List Of Tax Deduction For Businesses Cheng Co Group

Bengkung Belly Bind Postnatal Massage Belly Binding Postpartum Postpartum Belly

Fruits Fruit Fruit List Kinds Of Fruits

End Of Service Benefits In Saudi Labor Law Benefit Labor Law Employee Services

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Holiday13 960x960 Groovykindalove Makeup Set Benefit Cosmetics Love Makeup

Real Time Applications Of Smart Contracts And Blockchain Technology Blockchain Technology Blockchain Word Reference

Pin On Events Conferences Mmc Convert

Youtube Get A Loan Internet Jobs How To Get Rich

List Of Tax Deduction For Businesses Cheng Co Group